Are you considering purchasing a home but worried about affording the mortgage payments? FHA rental income might be the solution you need. The Federal Housing Administration (FHA) offers programs that allow homebuyers to use rental income from investment properties to qualify for a mortgage. This can significantly increase your purchasing power and help you secure the home of your dreams. Understanding how FHA rental income works is essential for potential homeowners, especially those looking to invest in multi-family properties. With the right knowledge, you can leverage rental income to build wealth and achieve financial stability.

In today's housing market, many individuals are exploring ways to maximize their earning potential. One such avenue is through FHA rental income, which can provide a substantial boost to your overall income when applying for a mortgage. This income can come from renting out an additional unit in a multi-family property or even from a basement apartment. By knowing the ins and outs of FHA lending guidelines, you can effectively navigate the process and make informed decisions.

Moreover, FHA rental income is not just about securing a mortgage; it’s also about creating long-term investment opportunities. As you consider your options, it's essential to weigh the pros and cons of utilizing rental income to qualify for financing. With the right strategy, you may find that FHA rental income opens doors to homeownership that were previously out of reach.

What is FHA Rental Income?

FHA rental income refers to the income generated from renting out a property that is financed through an FHA loan. This type of income can be used to qualify for a mortgage, helping homebuyers increase their purchasing power. The FHA allows borrowers to include rental income from properties they own or intend to purchase, provided they meet certain guidelines.

How Does FHA Rental Income Work?

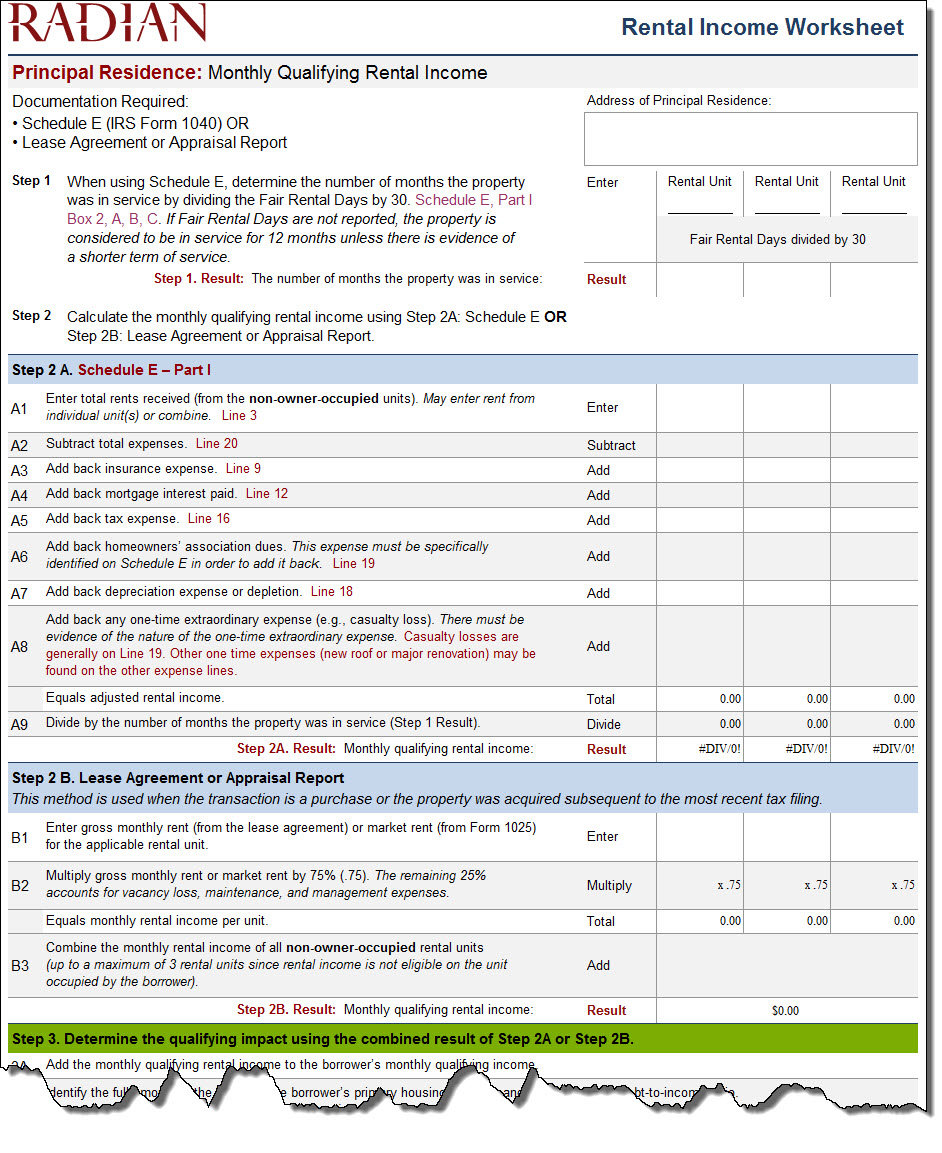

The FHA has specific guidelines regarding how rental income can be calculated and used in the mortgage application process. Here are the key points:

- The rental income must be documented, typically through tax returns or lease agreements.

- The borrower must have a history of receiving rental income, usually for at least two years.

- Future rental income from a property that is yet to be occupied may be counted, but it requires an appraisal to determine the property's rental potential.

Can You Use FHA Rental Income for Multi-Family Properties?

Yes, you can utilize FHA rental income when purchasing multi-family properties (up to four units). This can be an excellent investment strategy, as you can live in one unit while renting out the others, generating income to help cover your mortgage payments. The FHA encourages homebuyers to consider multi-family properties as a way to promote affordable housing options.

What Documentation is Required for FHA Rental Income?

When applying for an FHA loan and planning to use rental income, proper documentation is crucial. Here’s what you typically need:

- Two years of tax returns showing rental income.

- Current leases for all rental properties.

- Proof of consistent rental payments, such as bank statements.

How is FHA Rental Income Calculated?

The FHA has a specific method for calculating rental income, which often includes the following steps:

- Review the lease agreements to determine the monthly rental amount.

- Consider any vacancies or potential expenses, which may reduce the total income.

- Use the net rental income after expenses to calculate the amount that can be included in your mortgage application.

What Are the Benefits of Using FHA Rental Income?

Using FHA rental income can provide several advantages for homebuyers, including:

- Increased purchasing power, allowing you to buy more expensive properties.

- The ability to invest in multi-family homes and benefit from rental income.

- Potential tax advantages related to property ownership and rental income.

Are There Any Risks Associated with FHA Rental Income?

While there are benefits to using FHA rental income, it’s important to consider the risks as well:

- Market fluctuations can affect rental income stability.

- Management responsibilities for tenants can be demanding.

- Vacancies can lead to temporary loss of income.

How Can You Maximize FHA Rental Income for Your Home Purchase?

To make the most of FHA rental income when purchasing a home, consider the following tips:

- Research and select properties with strong rental potential.

- Keep detailed records of your rental income and expenses.

- Consult with a financial advisor or real estate agent experienced in FHA loans.

Conclusion: Is FHA Rental Income Right for You?

FHA rental income can be a valuable tool for homebuyers looking to enhance their financial situation and ease the burden of mortgage payments. By understanding the guidelines, documenting your income properly, and strategizing your investment, you can take advantage of this opportunity to secure a home that meets your needs and goals. Whether you are a first-time homebuyer or a seasoned investor, FHA rental income could be the key to unlocking your potential in the real estate market.

Article Recommendations

- Deacon Johnson

- How Old Is Miguel Diaz

- Arianna Lima 2024

- Risk Territory Between Ukraine And Siberia Nyt

- How Long Do Horses Live

- Lax Plane Spotting Locations

- Digital Strategy_0.xml

- Brand Building_0.xml

- Personal Wifi

- Efficient Strategies_0.xml