In today’s digital age, the rise of online transactions has also led to an increase in scams, one of which is the transact card scam. This fraudulent activity targets unsuspecting individuals, often leading to significant financial losses. As consumers, it's essential to stay informed and vigilant about such scams to safeguard our hard-earned money. In this article, we will delve into the intricacies of transact card scams, explore how they operate, and provide you with actionable steps to protect yourself against these malicious schemes.

Transact card scams can take various forms, ranging from phishing emails to fake websites that mimic legitimate financial institutions. Understanding the common tactics used by scammers is crucial in identifying potential threats before they cause harm. With the right knowledge and preventive measures, individuals can significantly reduce their risk of falling victim to these scams.

This comprehensive guide will not only cover the definition and types of transact card scams but also provide insights into recognizing red flags, reporting scams, and recovering from fraudulent activities. By the end of this article, you will be equipped with the knowledge to navigate the digital landscape safely and confidently.

Table of Contents

- 1. What is a Transact Card Scam?

- 2. Types of Transact Card Scams

- 3. Red Flags of Transact Card Scams

- 4. How to Protect Yourself

- 5. Reporting Scams

- 6. Recovery from Fraud

- 7. Conclusion

- 8. Additional Resources

1. What is a Transact Card Scam?

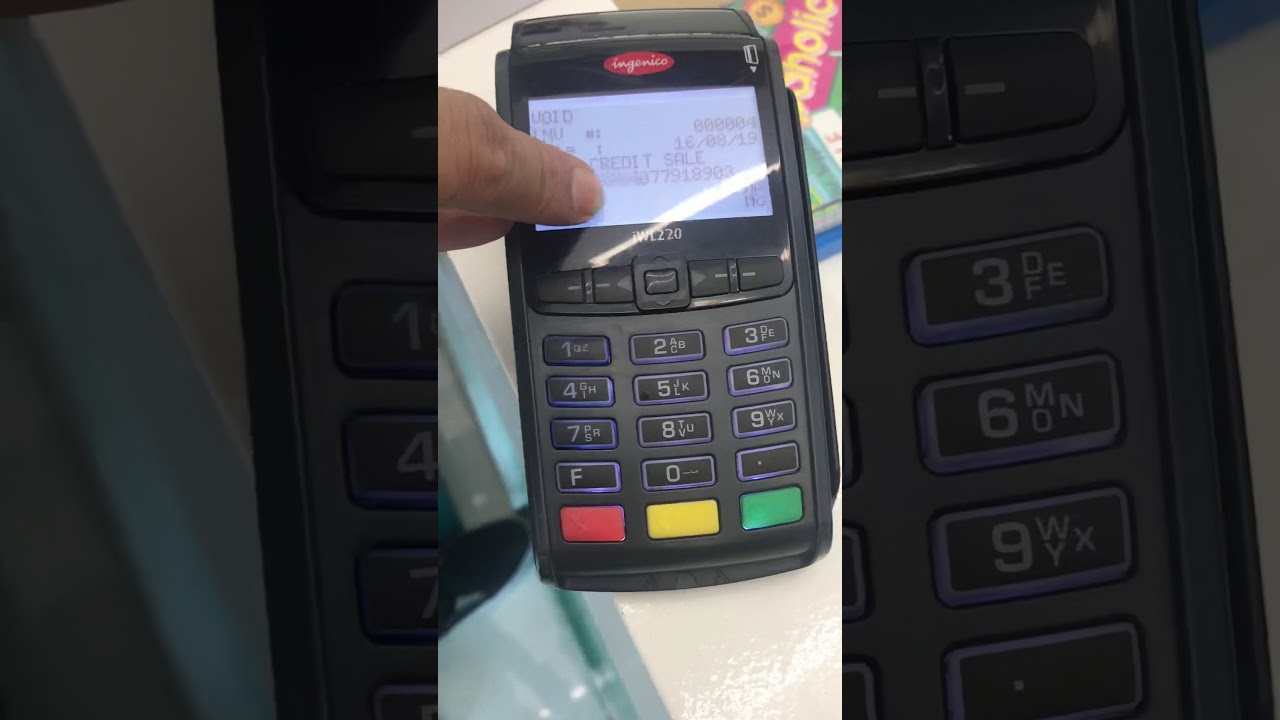

A transact card scam refers to any fraudulent scheme that involves the use of a payment card, such as credit or debit cards, to steal money or sensitive information from victims. Scammers often impersonate legitimate businesses or institutions to trick individuals into providing their card details or personal information. Once obtained, this information can be used to make unauthorized transactions or sell it on the dark web.

2. Types of Transact Card Scams

Transact card scams can be categorized into several types, each employing different tactics to deceive victims. Below are some of the most common types:

2.1 Phishing Scams

Phishing scams involve scammers sending fake emails or messages that appear to be from legitimate companies, urging victims to click on links or provide sensitive information. These emails often contain urgent messages about account verification or security breaches.

2.2 Carding Scams

Carding scams utilize stolen credit card information to make small purchases, testing whether the card is active before proceeding with larger transactions. Scammers often use automated tools to test stolen card numbers on various retail websites.

2.3 Fake Websites

Scammers create counterfeit websites that closely resemble legitimate ones to trick users into entering their payment card details. Once the information is submitted, it is captured by the scammers for fraudulent use.

3. Red Flags of Transact Card Scams

Identifying the signs of a transact card scam is crucial for prevention. Here are some common red flags to watch out for:

- Unsolicited emails or messages requesting personal information.

- Links that lead to unfamiliar or suspicious websites.

- Urgent requests for action regarding your account.

- Poor spelling and grammar in communications.

4. How to Protect Yourself

Maintaining good security practices can help you protect yourself from transact card scams. Here are some essential tips:

- Use strong, unique passwords for your accounts.

- Enable two-factor authentication whenever possible.

- Regularly monitor your bank statements for unauthorized transactions.

- Be cautious of unsolicited requests for personal information.

- Keep your software and antivirus programs up to date.

5. Reporting Scams

If you suspect you have been targeted by a transact card scam, it is vital to report it immediately. Here’s how:

- Contact your bank or card issuer to report unauthorized transactions.

- File a report with the Federal Trade Commission (FTC) or your country’s consumer protection agency.

- Notify local law enforcement if necessary.

6. Recovery from Fraud

Recovering from a transact card scam can be challenging but not impossible. Here are steps to take:

- Contact your bank to dispute fraudulent charges.

- Change your passwords and secure your accounts.

- Consider placing a fraud alert on your credit report.

7. Conclusion

In conclusion, understanding transact card scams is essential in today's digital landscape. By recognizing the signs and taking proactive measures, you can significantly reduce your risk of falling victim to these scams. Stay vigilant and informed, and don’t hesitate to take action if you suspect fraud.

8. Additional Resources

For further information and assistance, consider visiting the following resources:

We encourage you to share your thoughts and experiences in the comments below. If you found this article helpful, please share it with others to raise awareness about transact card scams. Stay safe and informed!

Thank you for reading, and we look forward to seeing you back on our site for more insightful articles.

Article Recommendations

- Digital Revolution_0.xml

- Healthy Habits_0.xml

- Lax Plane Spotting Locations

- Ella Bleu S Career Updates

- Streaming Device Whose Name Means Six

- Deacon Johnson

- Lava Stone Bracelet Essential Oil

- Clr Soak Overnight

- Debutante

- Business Tactics_0.xml