Monte Carlo simulation is a powerful statistical tool that allows users to model and analyze complex systems by simulating numerous scenarios and outcomes. Its application spans various fields, including finance, project management, and risk assessment. Excel, the ubiquitous spreadsheet software, offers a user-friendly platform for implementing these simulations, making Monte Carlo simulation accessible even to those with limited programming skills. By leveraging Excel's built-in functions and capabilities, users can easily conduct simulations that provide valuable insights into uncertainty and variability in their data.

Understanding how to perform Monte Carlo simulations in Excel can help decision-makers evaluate risks and make informed choices. This technique helps to visualize potential outcomes, enabling businesses and individuals to strategize effectively. With this article, we will explore the fundamental concepts of Monte Carlo simulation, its applications in various sectors, and the step-by-step process of executing these simulations in Excel.

Whether you are a financial analyst forecasting stock prices or a project manager assessing project risks, mastering Monte Carlo simulation in Excel can significantly enhance your analytical capabilities. In this comprehensive guide, we will delve into the nuances of this statistical method and provide you with the tools needed to harness its full potential through Excel.

What is Monte Carlo Simulation in Excel?

Monte Carlo simulation in Excel is a technique used to understand the impact of risk and uncertainty in prediction and forecasting models. By using random sampling and statistical modeling, it generates a range of possible outcomes based on different input variables. This approach allows users to visualize and quantify the risks associated with a specific decision or investment.

How Does Monte Carlo Simulation Work?

The Monte Carlo simulation works by performing the following steps:

- Define the problem or decision to be analyzed.

- Identify the input variables and their probability distributions.

- Run a large number of simulations to generate a range of possible outcomes.

- Analyze the results to determine the likelihood of different scenarios.

Why Use Excel for Monte Carlo Simulations?

Excel is an excellent tool for conducting Monte Carlo simulations due to its accessibility and versatility. Here are some reasons to consider using Excel for your simulations:

- User-friendly interface that requires minimal programming knowledge.

- Built-in functions and add-ins that simplify complex calculations.

- Ability to create visualizations, such as histograms and scatter plots.

- Widespread availability in business environments.

How to Set Up a Monte Carlo Simulation in Excel?

Setting up a Monte Carlo simulation in Excel involves several key steps. Here’s a simplified guide to get you started:

Step 1: Define Your Variables

Begin by identifying the key variables that will affect the outcome of your simulation. For instance, in a financial model, you may choose variables like interest rates, growth rates, and market volatility. Determine the range and distribution for each variable.

Step 2: Create a Random Number Generator

Excel provides various functions, such as RAND() and RANDBETWEEN(), to generate random numbers. Utilize these functions to create random inputs for your simulation based on the defined distributions.

Step 3: Run Simulations

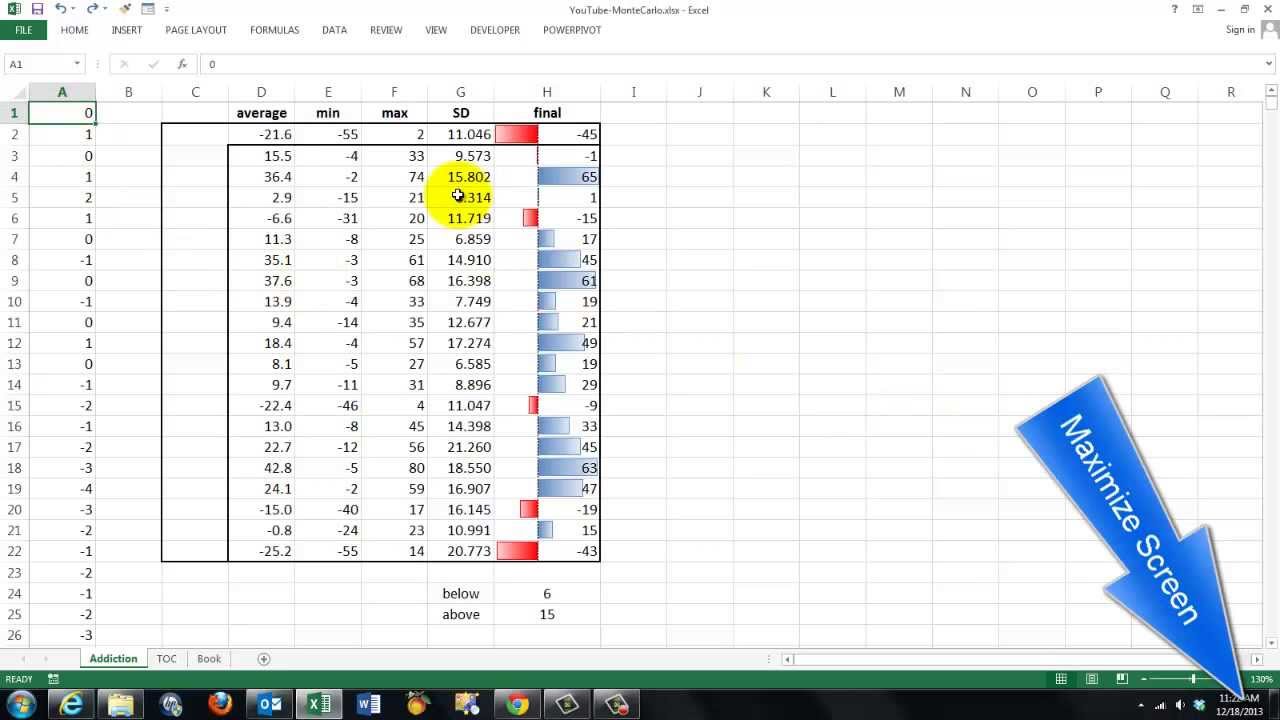

After setting up your variables and random number generators, replicate your model multiple times (often thousands) to create a distribution of outcomes. You can use the Data Table feature in Excel for this purpose.

Step 4: Analyze Results

Once you have collected the results of your simulations, analyze the data to identify trends, probabilities, and potential risks. Visual tools like charts and graphs can help in interpreting the results effectively.

What Are the Applications of Monte Carlo Simulation in Excel?

Monte Carlo simulation has diverse applications across various sectors. Here are some notable examples:

- Finance: Used for portfolio optimization, risk assessment, and forecasting stock prices.

- Project Management: Helps in estimating project timelines and budgets by simulating various scenarios.

- Engineering: Assists in reliability analysis and performance prediction of systems.

- Healthcare: Aids in resource allocation and risk evaluation in medical research.

Are There Any Limitations to Using Monte Carlo Simulation in Excel?

While Monte Carlo simulation is a powerful tool, it does have some limitations when implemented in Excel:

- Excel may struggle with very large datasets, leading to performance issues.

- Complex models can become cumbersome and challenging to manage.

- Accuracy is heavily dependent on the quality of input data and assumptions.

How to Improve Your Monte Carlo Simulation Skills in Excel?

To enhance your Monte Carlo simulation skills in Excel, consider the following tips:

- Take online courses or tutorials focused on Excel and Monte Carlo simulations.

- Practice with real-world datasets to gain hands-on experience.

- Join forums or communities where you can ask questions and share knowledge.

Conclusion: Embrace the Power of Monte Carlo Simulation in Excel

Monte Carlo simulation is an invaluable technique for navigating uncertainty and making informed decisions. By mastering this method in Excel, you can elevate your analytical skills and enhance your understanding of risk management. Whether for personal finance, project management, or business strategy, the ability to simulate various outcomes can lead to more robust and confident decision-making.

As you explore the capabilities of Monte Carlo simulation in Excel, remember that practice and experimentation are key. The more you apply this powerful technique, the more adept you will become at interpreting results and leveraging insights to drive success.

Article Recommendations

- Outdoor Propane Heater Table Top

- Japanese Watch Brands

- Corinne Foxx

- Ne Yo

- 76 Out Of 80

- Global Impact_0.xml

- Dinosaur Dung

- Clr Soak Overnight

- Lava Stone Bracelet Essential Oil

- Business Resilience_0.xml